If you plan to launch a website or an app that gives users the opportunity to buy your products or services, one thing you will need to decide before proceeding to development is how payments will be processed. You must take into account factors such as convenience and security of transactions. But you should also analyze available options from the perspective of developers, with regard to issues such as simplicity of integration, accessibility of tech support, and a community that can provide necessary assistance.

In this article, we’ll explain why payment APIs are so popular these days and list some of the top payment gateway API options.

This information will be of great use and help you make the right choice for payment gateway API integration.

What is a payment gateway API?

To begin with, let’s clearly state what payment processing APIs are.

“API” stands for "Application Programming Interface”. This can be defined as an intermediary that lets two separate apps interact with each other. For example, when you want to book a trip or a gift card on a third-party aggregator website, an API will organize communication between the website and the company that will directly provide the chosen services.

Payment gateway APIs are integrated with the digital processes of your app or website and are intended to connect your checkout system to a payment network. These APIs are an alternative to hosted checkout services usually utilized by eCommerce websites.

How does a payment gateway API work?

As the majority of web APIs act as intermediates between the app and the server, their work is organized in the following way.

First of all, a user calls an API, which lets the app know what action is expected from it. The next move is executed by the app, which uses the API to send a request to the server. In turn, the server gets information about what it should do and sends the necessary data as a reply (or performs the expected action).

A payment gateway API usually works quite similarly to what we’ve described above: your app sends a request to the API, which functions as an intermediary between your software solution and the payment processing network. After that, the network processes the request received from the API and sends a response to it. Then, the API responds to the app, based on the network’s reply

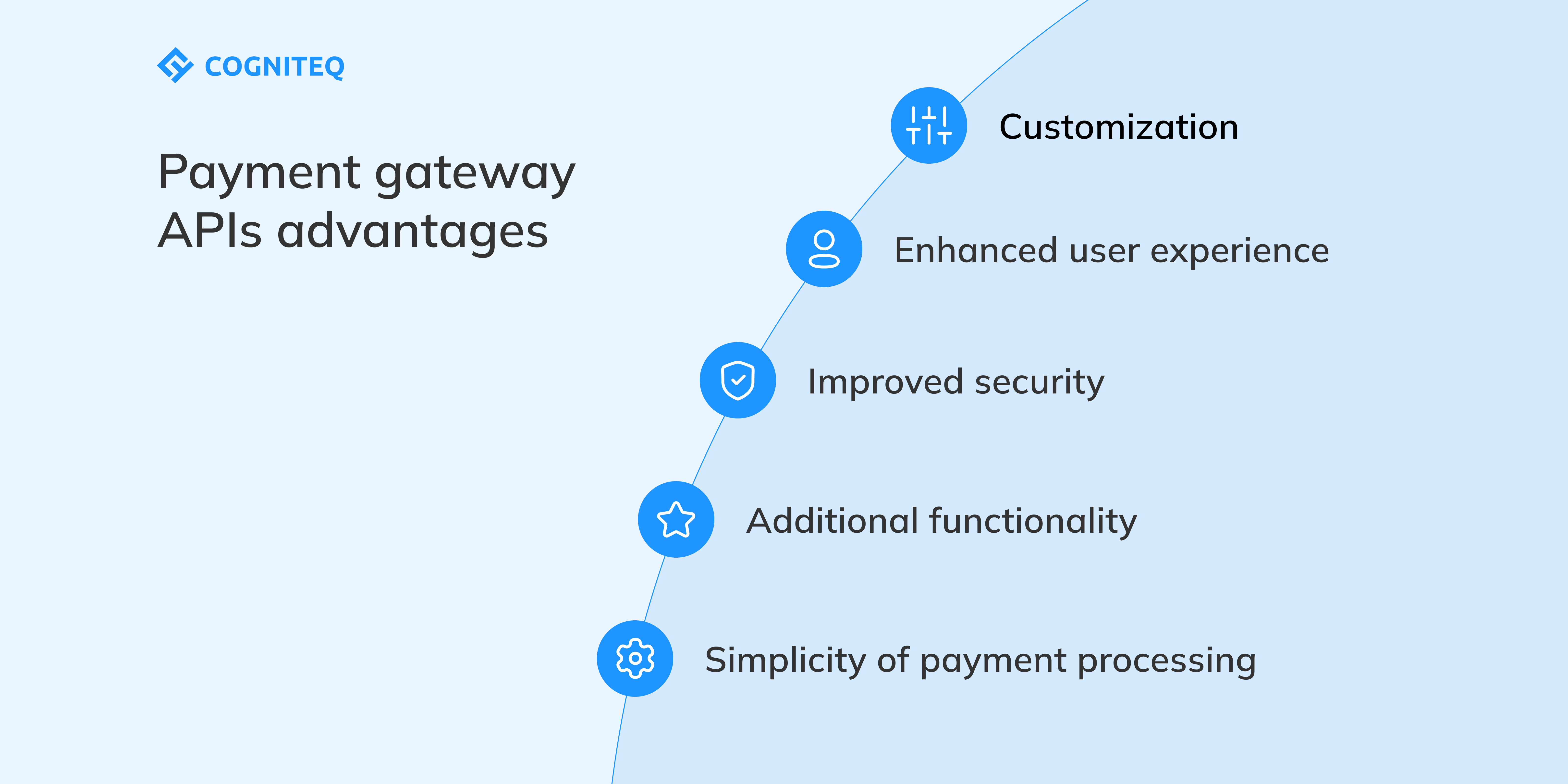

Benefits of using payment APIs

Let's discuss some of them.

The simplicity of payment processing

First, it’s important to highlight that APIs greatly facilitate all payment-related procedures, including authorization, request, confirmation, and receipt.

Enhanced user experience

With APIs, all the processes become much easier for customers. For example, there is no need to fill out a checkout form, which typically makes the interaction less convenient and may lead to mistakes. If you have an integrated API, your clients can just use the stored payment details and make their purchases with a couple of clicks.

Customization

You may think that if you’re using a payment processing API you are obliged to use it exactly as it is. But APIs can be customized to better meet your precise business needs. With APIs, you can also ensure that your corporate branding provides a consistent checkout experience for users across all the channels of interaction with them.

Improved security

As payment details and customer data are usually stored not by the merchant but by the API provider, it is possible to keep sensitive data more protected and ensure better regulatory compliance.

Additional functionality

By using APIs, developers can easily add some extra features to your app. For example, you can provide users with the option of storing and viewing transactions offline. It’s also possible to add different payment methods and support different card brands.

Need to integrate a payment gateway API in your solution?

We will help you to choose the best solution given the needs of your project!

Top 7 payment gateway APIs

Now let’s have a look at the most popular payment processing APIs. Maybe when you will need to conduct payment gateway API integration, you’ll choose one from this list.

Stripe API

What this API offers: As you may have already guessed, this payment gateway API provides developers with access to the functionality of Stripe, including accepting and processing payments, tracking user accounts, working with subscriptions, and sending invoices.

Stripe Payments is a full-stack payment processor. That means that it offers the features of a gateway and an external payment processor under one roof. This can be a disadvantage for those businesses that already have a merchant account they want to continue using. With Stripe, you can’t use only its gateway functionality; you need to use both.

Developers praise Stripe for good tech documentation and simplicity of integration.

Compatibility: It supports the following server-side languages: PHP, Node.js, Go, Python, Java, .NET, Ruby.

Costs: The fee taken by Stripe is 2.9% + $0.30 per payment.

Our developers have rich expertise in working with Stripe API, which allows them to find the best and most feasible approaches to the integration of this solution into apps of different types. You can read about our successfully launched projects in our portfolio, and here is just one example of the solutions that were built by our team and powered with this payment API.

Square API

What this API offers: Square’s Payments API is a modern tool that lets businesses accept payments made via credit and debit cards directly on their corporate/commercial websites. Companies themselves do not need to deal with sensitive client data used for payments. The process of payment processing is conducted fully via Square, which guarantees data protection and security.

Businesses can have a look at their sales activity on the dashboard provided by the Square platform. To get the money received via this payment solution, businesses must connect their bank accounts.

Square’s Payments API allows accepting payments from Visa, Mastercard, American Express, Discover, JCB, and UnionPay cards. It’s also possible to support prepaid and gift cards issued by one of the companies mentioned above. With this API, you can also process payments made via Apple Pay.

Compatibility: This payment gateway API can be integrated into Android, iOS, Flutter, and React Native applications.

Costs: The integration of Payments API is free of charge. But Square takes a fee for each transaction that starts at 2.6% + $0.10.

Adyen API

What this API offers: Adyen is a credit card processor that provides sellers with payment forms. As the platform is available across all continents, it supports many different payment methods and currencies.

The offered API lets developers create integrations that allow access to the company’s infrastructure. The documentation by Adyen is broken up into various sections, such as those related to point of sale, plugins, payments, etc. This makes the interaction of developers with the API more convenient and efficient.

Compatibility: The API can be integrated into both iOS and Android apps.

Costs: The company has a hybrid pricing system based on the type of cards used for payments. For example, if you have a Discover or American Express card, there is a flat rate for you (3.95% + $0.12). Each Mastercard and Visa cardholder has to pay a fee at an interchange rate + $0.12.

Klarna API

What this API offers: The payments API is intended for offering access to Klarna's payment methods, which will become a part of your checkout procedures. Thanks to API integration, your clients will be offered Klarna’s accepted payment methods and will have the ability to choose the most convenient option for them. At the moment, Klarna accepts all popular debit and credit cards, including but not limited to Mastercard, Visa, AMEX, and Discover. Prepaid cards are not currently supported.

Klarna allows style customization to adapt its Payments service to your corporate branding.

Compatibility: This payment API can be used for native or hybrid iOS and Android apps.

Costs: The fees Klarna takes from businesses differ depending on the country of their location. On average, a fee per transaction via this payment solution is around 2-2.5% + 0.35 EUR.

PayPal API

What this API offers: PayPal is a widely used payment system. It is known for its convenient and secure transactions. As a credit card number and bank account details are stored on trusted servers, parties to the transactions do not need to reveal data to each other to make or receive payments.

As is clear from its name, PayPal API is used to ensure the ability to get payments from PayPal users.

Thanks to the very high level of security of this service, all transactions, including recurring payments, will be fully protected even on low-security websites.

Users can use both credit and debit cards for making online transactions, but what’s even more interesting is that every PayPal client can buy and sell cryptocurrencies as well as use them for payments. Given the mass adoption of crypto all over the world, this feature is a promising one.

Compatibility: The payment gateway API can be integrated into iOS, Android and React apps, among others.

Costs: As for subscriptions and their costs, PayPal has different pricing models: Fixed price, Quantity, also known as user or seat-based, Volume-based, and Tiered-based.

Google Pay API

What this API offers: The payment gateway API allows for making transactions in one click, using one of the payment options saved on the relevant Google Account. When users want to pay via Google Pay, they get access to a list of available options that they had previously added to their accounts.

The API also lets users set recurring billing (for example, for monthly phone bills) that will be tied to the chosen payment method.

Google also makes it possible for NPOs (nonprofit organizations) to collect donations via the Google Pay API. However, to enjoy this opportunity, organizations must prove their nonprofit status with relevant documentation.

From the perspective of developers, this API is quite simple to use, as it can be integrated with just a couple of code lines.

Compatibility: This API can be used for building Android and web apps.

Costs: Google doesn’t take any fees for using its API. There are no fees for users, merchants, or developers. Merchant account owners must pay only processing fees taken by their payment processors.

Apple Pay API

What this API offers: Apple Pay ensures seamless and fast payments conducted via traditional credit and debit cards, as well as other methods. If your app is integrated with this payment system, transactions take a single click, which makes this method one of users’ most preferred choices for making transactions.

Apple allows using its API for making payments in iOS, iPadOS, and watchOS apps, and on websites in the Safari browser.

Apple Pay provides increased security of payments, as each transaction requires confirmation via Face ID, Touch ID, or a passcode. Merchant account owners do not deal with customers’ sensitive data directly in their systems.

Moreover, thanks to tokenization, Apple Pay is practically impossible to hack.

Compatibility: Apple offers two APIs for its service: Apple Pay JS and Payment Request API. Apple Pay JS API is supported in iOS 10 and later, and macOS 10.12 and later, while Payment Request API is supported in iOS 11.3 and later, and Safari 11.1 on macOS 10.12 and later.

Costs: There are no fees for businesses that want to accept payments via Apple Pay. Apple introduces transaction fees for credit card issuers of 0.15% of a purchase cost to guarantee the security of tokenization.

How to choose a payment gateway API?

When you decide that you want to power your app with a payment processing API, there is one logical and obvious question. Which one should you choose?

There are some clear factors in your choice, price definitely being one of them. Make sure your choice fits your budget and business model. But don’t forget to take into account the following questions:

- Is it possible to integrate the chosen payment processor API with your software?

- Can you ensure the chosen API works in your target country(ies)? Can full regulatory compliance be provided?

- What functionality and customization options are available?

- Do your developers have experience in working with this API? (Bear in mind that if you want to integrate an API your developers have never worked with, there is a risk that integration will take a long time and cost much more than expected.)

- What about documentation? (With well-known solutions, there shouldn't be any problems with their tech documentation, but if you want to integrate a less-known API, check the availability of the necessary docs.)

Final word

If you want to launch a solution that has functionality for processing payments, a payment API definitely can be a good choice. This will not only reduce the time needed for development and design (and consequently, the cost) but also ensure a high level of security and stability of payment processing.

At Cogniteq, we are always ready to help you build innovative and reliable solutions that will boost the growth of your business and increase the loyalty of your clients. Contact us via our website! We would be happy to become your IT partner for years to come.